If you’re still relying on your old competitor list, you’re already behind.

Let’s be honest—that list probably focuses on the usual suspects, the direct business rivals you’ve tracked for years. But it completely misses the new players that AI search has pushed onto the field. In fact, a 2024 HubSpot report found that 64% of marketers believe AI search will fundamentally change their SEO strategy, highlighting the need to identify these new competitors.

In this new reality, your biggest threat might not be another company selling the same product. It could be a niche blog, a forum thread, or a research paper that Google’s AI Overviews constantly cites as the definitive source.

The lines have blurred, and the battlefield is more crowded than ever.

A Modern Definition of a Competitor

To really get a handle on your market position, you have to look beyond the obvious. Your competition now falls into several distinct categories, and each one needs a different strategy.

- Direct Competitors: These are the ones you know well. They offer a similar product or service to the same audience. Think Coca-Cola vs. Pepsi. Simple.

- Indirect Competitors: These companies solve the same customer problem but with a totally different solution. If you run a taxi service, your indirect competitors are the city bus system and the local bike rental app.

- SERP Competitors: This is anyone and everyone ranking for your target keywords, even if they aren’t selling a thing. It could be a review site, a major publication like Forbes, or a one-person blog with incredible authority on a specific topic.

- AI Answer Engine Competitors: This is the newest and most disruptive group. These are the sources—articles, forum threads, and data reports—that models like ChatGPT and Google AI Overviews cite to answer your customers’ questions.

Imagine discovering that a niche Reddit thread, not your main rival, is answering your customers’ most critical questions in AI-generated results. This is the new reality of competition.

Finding who you’re up against starts with a few manual Google searches for your core keywords. But to do this right, you need to bring in data. SEO tools like Ahrefs or Semrush are non-negotiable here.

According to a study by Semrush, top-ranking sites for high-volume keywords often share a 40-60% keyword overlap with their direct rivals. That’s a massive signal telling you who’s really fighting for the same turf.

This multi-layered approach isn’t just a nice-to-have; it’s essential for survival. Building a strategy that works today requires strong search marketing intelligence that accounts for every single player on the field, not just the ones you already know.

Finding Hidden Competitors with Smart Search Tactics

Before you jump into a pile of analytics tools, let’s start where your customers do: Google.

Getting good at manual discovery helps you see the competitive landscape through your audience’s eyes. It often uncovers rivals that automated tools completely miss. This is more about being a detective than a marketer.

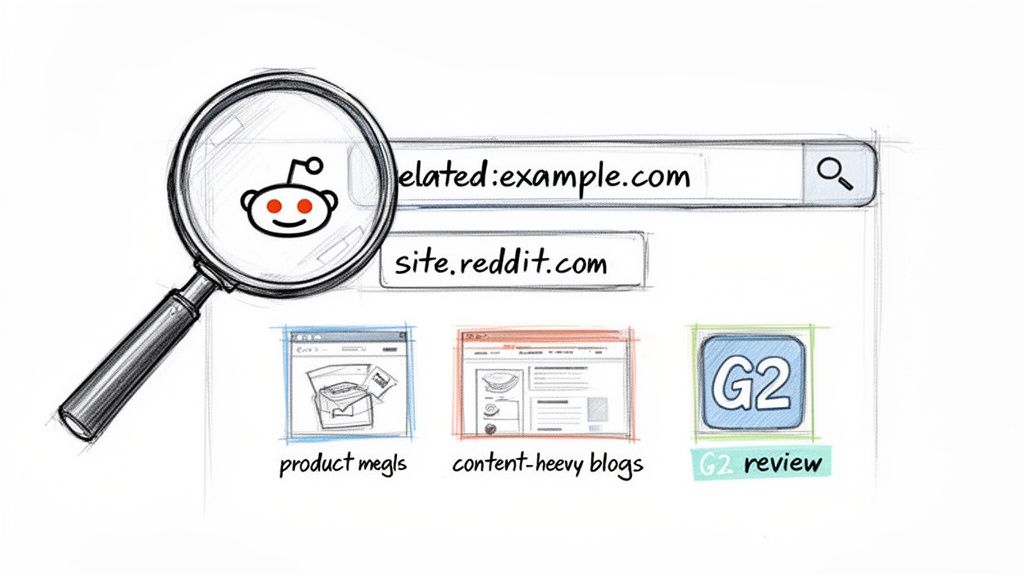

The easiest first move is using advanced search operators. These are simple commands you add to a search to tell Google exactly what you want, filtering out all the noise. For competitor research, the related: operator is pure gold.

Uncover Lookalikes with Advanced Operators

Let’s say you run a project management software company and you know Asana is a big player. Instead of just Googling “Asana alternatives,” you can get more objective results by searching:

related:asana.com

Google’s algorithm will instantly show you a list of websites it sees as thematically and structurally similar. This little trick is brilliant for surfacing emerging startups or niche tools that haven’t hit the mainstream yet.

While not an official statistic, SEO experts often report that the related: operator can identify up to 30% more indirect competitors than a standard keyword search alone.

Pro Tip: Don’t just run this on your competitors. Search for

related:[yourdomain].com. The results can be a serious reality check, showing you who Google actually thinks your peers are.

Listen In on Online Communities

Your audience isn’t just searching on Google; they’re asking for real advice in online communities. These are the places you get an unfiltered view of the market, revealing who people genuinely trust and recommend. In fact, Nielsen data shows that 83% of consumers trust recommendations from peers over advertising.

- Industry Forums: Niche forums are treasure troves. Find threads where people are discussing problems your product solves and see which brands keep getting mentioned.

- Review Sites: Platforms like G2 or Capterra (for software) or Yelp (for local businesses) literally pit you against competitors. Don’t just look at the ratings; read the language customers use in their reviews.

- Social Platforms: Reddit is especially powerful for this. Look for subreddits in your niche (like r/saas or r/skincareaddiction) and search for phrases like “best alternative to” or “[your brand] vs.”

The conversations in these spaces are raw, honest, and incredibly valuable. They show you which brands have earned real trust and what specific pain points customers have with what’s already out there. You can learn more about how to use Reddit to get AI mentions and build visibility where it matters most.

By the time you finish this manual sweep, you’ll have a solid starting list of direct, indirect, and SERP competitors. This qualitative intel is the perfect foundation for the next stage, where we’ll use data to validate and expand on what you’ve found.

Using SEO Tools for a Data-Driven Market View

While manual searches give you a feel for the terrain, relying on them alone is like navigating with a compass instead of a GPS. To truly understand how to find competitors of a website, you need hard data.

This is where SEO tools like Semrush, Ahrefs, and SimilarWeb come in, transforming your research from guesswork into a data-backed market map.

These platforms sift through millions of data points to show you who you’re actually up against—not just who you think your competitors are. I’ve often been surprised to find that a brand’s toughest competition isn’t another big name, but a high-authority blog or a niche affiliate site that’s quietly winning over the target audience.

Pinpoint Your True SERP Rivals

The quickest way to get a data-driven competitor list is by running an “Organic Competitors” or “Competing Domains” report in a tool like Ahrefs or Semrush. You just plug in your domain, and the tool cross-references its massive keyword index to find sites that rank for a similar set of terms.

These reports instantly surface a few critical metrics:

- Competition Level: A score showing how much another site’s keyword footprint overlaps with yours.

- Common Keywords: The exact number of keywords you and a competitor both rank for.

- Competitor’s Keywords: The total organic keywords a rival domain ranks for, giving you a sense of their overall SEO scale.

This process puts real numbers behind your analysis. It turns a vague list of potential rivals into a prioritized map of your actual search competitors, showing you exactly who to watch and where to focus your efforts.

Analyze Traffic Sources for a Fuller Picture

Knowing who you compete with for keywords is just one part of the puzzle. Understanding how your rivals attract visitors gives you a massive strategic advantage.

Tools like SimilarWeb are brilliant for this. They reveal the entire traffic mix for any website, showing you whether a competitor is winning with organic search, direct traffic, paid ads, or referrals.

This kind of analysis often uncovers hidden opportunities. For example, data from SimilarWeb shows that the top 100 websites get nearly 60% of their traffic from direct sources and 30% from organic search. If you find a competitor thriving on referral traffic, you can investigate their backlink profile to find new partnership opportunities.

A deeper look might reveal that a huge chunk of that social traffic is coming from one specific channel. For instance, Reddit could be driving significant referrals for a competitor, a crucial insight given that Google now prominently features Reddit discussions in search results.

For a focused approach, dedicated social media competitor analysis tools can give you invaluable insights into your rivals’ strategies on those platforms.

Competitor Analysis Tool Comparison

To help you choose the right tool for the job, here’s a quick breakdown of some of the most popular platforms and what they’re best for.

| Tool | Best For Identifying | Key Feature | Example Use Case for Airefs User |

|---|---|---|---|

| Ahrefs/Semrush | SERP Competitors | Keyword Gap & Competing Domains reports. | Find who you’re competing against for high-intent prompts in traditional search. |

| SimilarWeb | Traffic Competitors | Detailed traffic source breakdown (organic, direct, social, paid). | Discover a rival gets significant traffic from a social channel you’ve ignored. |

| BuzzSumo | Content Competitors | Identifies top-performing content by topic or keyword. | See which blogs or media sites are creating the most shared content in your niche. |

| BuiltWith | Tech Stack Competitors | Reveals the technology stack behind any website. | Identify competitors using the same marketing automation or analytics tools as you. |

Each tool offers a unique lens for viewing the competitive landscape. Using a mix of them gives you the most complete picture of who you’re up against and where their strengths lie.

Once you have this data-backed list of competitors, the real work begins. The goal isn’t just to know who they are, but to dissect their strategies by digging into their content, analyzing their backlink profiles, and understanding why they’re winning.

To keep tabs on your own performance against these newfound rivals, you’ll want to explore the best SEO ranking reporting software to monitor your progress effectively.

Uncovering Opportunities with Gap Analysis

Okay, so you’ve identified your competitors. That’s a great start, but it’s just the first step. The real win comes from finding the strategic high ground, and that’s where gap analysis becomes your secret weapon.

It’s all about systematically finding what your rivals are doing successfully that you aren’t—and then creating a clear roadmap to close that gap.

The most powerful place to start is with a keyword gap analysis. This process pinpoints valuable keywords your competitors are ranking for, but your website doesn’t even touch. Imagine finding out several rivals are pulling in serious traffic from terms like “how brands influence Google AI Overviews,” revealing a whole content pillar you’ve completely missed.

Pinpointing Keyword Gaps

Running a keyword gap analysis in a tool like Semrush or Ahrefs is a proven way to find both hidden competitors and massive untapped opportunities. This isn’t a minor tweak; case studies frequently show businesses increasing organic traffic by over 30% after implementing a content strategy based on keyword gap analysis.

It’s pretty straightforward. You load your domain and a few key competitors into the tool. It then spits out a list of terms they rank for that are totally absent from your strategy. You might find long-tail keywords with significant monthly searches just waiting for you.

You can learn more about how to interpret these findings in our analysis of 14 million AI search results.

Before diving headfirst into competitor research, it’s a good idea to run a self-assessment. Using a comprehensive website audit checklist can shine a light on your own strengths and weaknesses, giving you a much clearer focus for your gap analysis.

Applying Gap Analysis to Backlinks

This same logic applies directly to backlinks. The goal isn’t just to count how many links your competitor has; it’s to figure out where they’re coming from. A backlink gap analysis reveals high-authority domains linking to multiple competitors but not to you.

This isn’t just about link building; it’s about network building. Finding these shared sources shows you which publications, blogs, and forums are considered authoritative voices in your niche. Earning a link from them is a powerful endorsement.

Here’s how to put this into practice:

- Identify Common Referring Domains: Use your SEO tool of choice to find websites that link to two or more of your top competitors.

- Filter for Quality: Don’t chase every link. Prioritize domains with high authority scores and direct relevance to your industry. A link from a niche blog is often worth more than one from a generic directory.

- Analyze the Context: Click through and visit the linking pages. Are they resource lists? Product reviews? Guest posts? Understanding why they linked out informs your entire outreach strategy.

- Create Your Outreach List: Now you have a highly targeted list of websites already familiar with your market. They’re much more likely to be receptive to a pitch for high-quality content or a collaboration.

This methodical approach turns what is often a reactive SEO tactic into a truly proactive strategy. It ensures you’re focusing your energy on the opportunities with the highest potential impact.

Uncovering Your True Competitors in AI Search

The game has changed. It’s no longer just about ranking for keywords. Now, it’s about becoming the trusted source that AI models use to answer your customers’ most pressing questions.

This shift means we have to think differently about who our competitors are. We’re moving from a world of search terms to one driven by the high-intent prompts people type into AI assistants.

Your rivals in this new space are often not who you think. They might not be direct product competitors at all. Instead, they’re the influential blogs, data-heavy reports, or specific forum discussions that AI models consistently cite in their answers.

From Keywords to Buyer Questions

First things first: you need to get inside your customers’ heads. What are the core questions they ask when looking for a solution like yours?

Stop tracking generic keywords like “project management software.” Instead, start monitoring prompts like:

- “what is the best project management tool for a small remote team?”

- “how does Trello compare to Asana for marketing campaigns?”

When you track these prompts, you start to see a pattern. You’ll discover which sources the AI models lean on for their answers. A SaaS company might find that a single industry publication gets cited far more often than any other brand for its top buyer questions.

That publication is now a primary “AI search competitor.” Your job is to analyze its content and figure out how to do it better.

Winning in this new landscape means becoming the authority not just in Google’s eyes, but in the “mind” of its AI. The sources cited in AI Overviews and other answer engines are your new front-line competitors for trust and visibility.

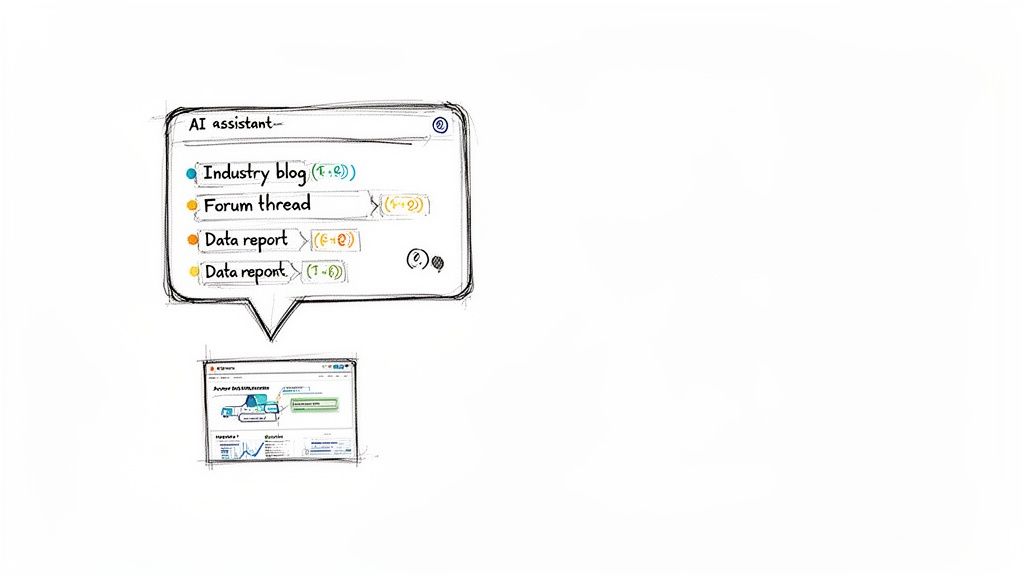

Tracking and Analyzing AI Citations

Once you have a list of priority prompts, the next step is to track them consistently. Checking each one by hand is a losing battle—the results change constantly. This is where specialized platforms come in handy, giving you a continuous feed of insights.

A good monitoring tool will show you:

- Who gets cited most often: Pinpoint the domains that consistently show up in answers related to your market.

- What type of content is preferred: Are AI models citing long-form blog posts, statistical reports, or user reviews?

- How your brand visibility compares: Benchmark your mentions against competitors to measure your share of voice in the answer engine ecosystem.

This isn’t just a nice-to-have. Gartner predicts that by 2026, traditional search engine volume will drop by 25% as more people turn to AI chatbots for answers. Figuring out how to find competitors in this new context is a survival skill.

If you want to go deeper on this, our guide to AI search engine optimization has actionable strategies for this new era.

By identifying and analyzing your AI search competitors, you turn the black box of answer engines into a clear set of opportunities. You’ll know exactly what content to create and which platforms to engage with to become the go-to source for your audience’s most important questions.

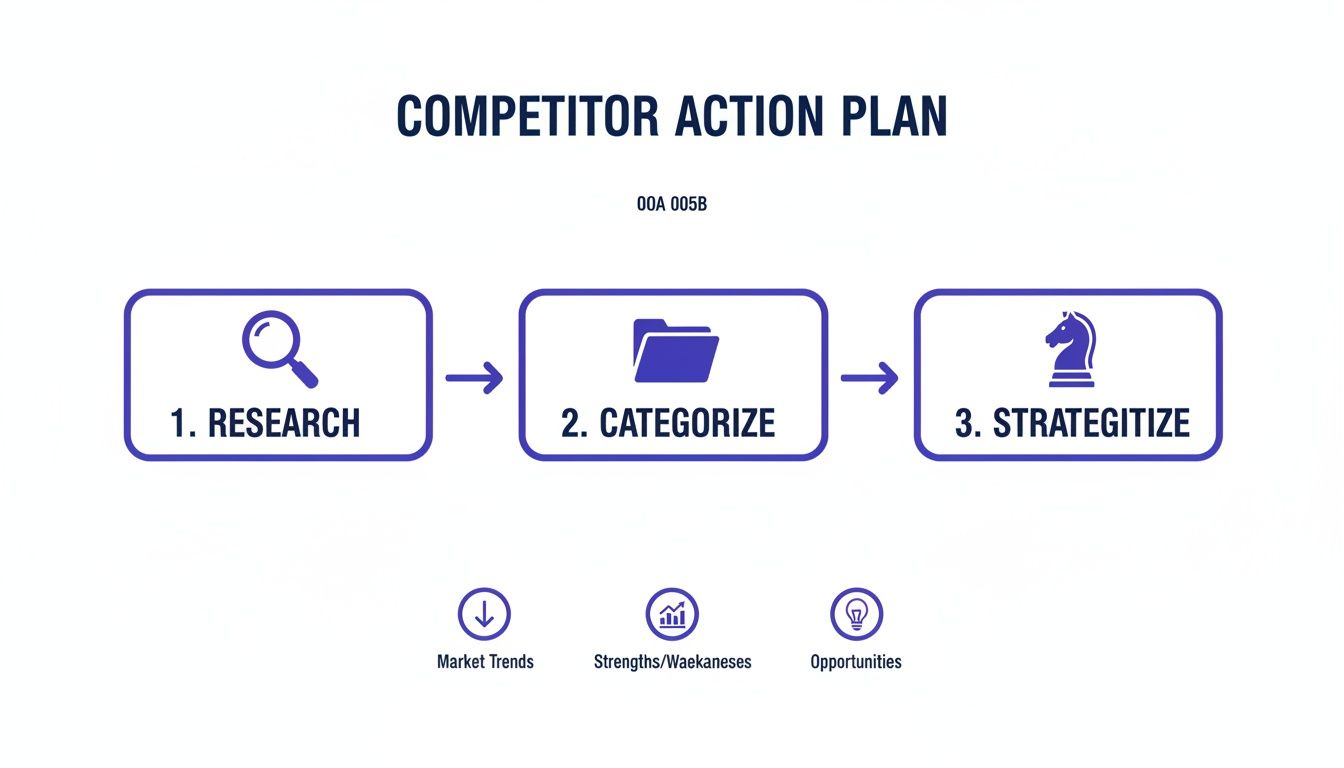

Turning Research into an Actionable Strategy

A long list of competitors is just noise. To make it useful, you need to turn that raw data into a clear, strategic game plan. The goal isn’t just to know who your rivals are—it’s to figure out how to beat them.

The first move is to categorize your competitors into tiers. This stops you from treating a small niche blog with the same urgency as a direct business threat. A simple tiering system brings instant focus.

Creating Actionable Competitor Tiers

Think of this as your priority map. Not everyone deserves the same level of attention.

- Tier 1: Direct Threats. These are the rivals showing up in both traditional search results and AI-generated answers for your most critical, buyer-intent prompts. They’re fighting for the same customers you are, right now.

- Tier 2: Content & AI Competitors. This group is full of high-authority blogs, industry publications, or forums that consistently own the top spots for informational queries and get cited in AI answers. They might not sell what you sell, but they own the conversation.

- Tier 3: Emerging & Indirect Players. This is your “watch list.” It’s for up-and-comers or indirect rivals you want to keep an eye on. The goal here is observation, not an all-out counter-attack.

Organizing your competitors this way is critical. According to a study from Crayon, 90% of businesses report that their industry has become more competitive, and 80% of those who systematically monitor their rivals see a direct, positive impact on revenue. Prioritization turns a messy list into a focused action plan.

Building Competitor Profiles

Once you have your tiers, create a simple profile for each Tier 1 and Tier 2 competitor. Don’t drown yourself in data; just grab the metrics that tell you what to do next. You want a scannable overview that highlights their strengths and, more importantly, your opportunities.

Your profiles should track:

- Top Performing Content: What articles or pages are driving the most traffic for them?

- Primary Keyword Groups: Which keyword clusters do they absolutely dominate?

- Backlink Velocity: Are they actively building new, high-quality links, or have they stalled?

- AI Answer Visibility: How often are they cited when someone asks your top 10 buyer questions?

This approach transforms a one-off project into a continuous intelligence loop. Refreshing this data quarterly keeps your strategy sharp and helps you stay one step ahead.

This process is all about moving from broad research to specific, strategic actions that get results.

Frequently Asked Questions

Even with a solid game plan, a few questions always pop up when you start digging into the details of competitor analysis. Here are the most common ones.

How Often Should I Perform a Competitor Analysis?

For a full, deep-dive analysis, you should do this at least quarterly. Markets shift, new players emerge, and strategies change, so you need a regular cadence to catch these moves. That said, for your top-tier, direct rivals, I recommend a lighter monthly check-in. Just a quick look at their new content and AI search visibility is enough to make sure you’re not blindsided by a new campaign.

What Is the Biggest Mistake in Competitor Analysis?

The most common trap is focusing only on direct product competitors. It’s an easy mistake to make, but this narrow view means you completely miss the influential content sites, industry blogs, and even forum threads that often dominate AI search results and SERPs. A study from Crayon’s State of Competitive Intelligence report found that 77% of businesses overlook their indirect competitors, leaving massive opportunities on the table.

The real competition isn’t just who sells what you sell; it’s who answers the questions your customers are asking. Ignoring your content and AI search rivals means you’re fighting on an incomplete battlefield.

Which Competitor Metrics Are Most Important?

Forget vanity metrics like follower counts. The data that actually helps you make decisions comes from tracking a few key things:

- Keyword Gaps: Find the valuable keywords your competitors are ranking for that you aren’t. It’s the lowest-hanging fruit for content strategy.

- Share of Voice in AI Answers: Measure how often your brand is cited versus rivals for your key buyer questions in tools like ChatGPT or Perplexity. This is your new visibility benchmark.

- New Backlink Sources: See which high-authority sites are linking to your competitors. This is a ready-made list for your own outreach efforts.

How Can Small Businesses Compete with Established Players?

Smaller businesses can absolutely win by being more agile. Instead of trying to outspend the big guys, focus on targeting niche, long-tail keywords that larger brands often ignore because they don’t see them as worth the effort. According to Ahrefs data, over 92% of all keywords get ten searches per month or fewer, representing a massive untapped opportunity for smaller, focused businesses. Another huge advantage is prioritizing visibility in AI search. Bigger companies are often slower to adapt their content strategies for this new channel, which gives you a chance to get in early and own the conversation before they do.

Ready to stop guessing and start winning in AI search? Airefs is the action platform that shows you exactly who your competitors are in AI answers and how to outperform them. Track your AI search visibility, uncover hidden content opportunities, and turn insights into a measurable growth strategy. Discover your true AI competitors with Airefs.